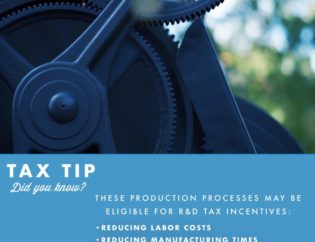

Tax law changes under the PATH Act of 2015 have benefited smaller start-up businesses defined as average gross receipts of five million or less within the last five years. Starting in 2016, taxpayers can claim the research and development credit as an offset against payroll taxes. This is more valuable for a start-up since they might not yet have profits and taxes that can be offset by the credit. Allowing the reduction of payroll taxes is an immediate benefit that should help smaller companies create more jobs and accelerate growth in the overall economy.

We receive a lot of questions related to the federal R&D tax credit and how it can benefit startups and smaller companies in particular. Common questions include:

- What activities qualify?

- What expenses qualify?

- Does a company have to be a “startup” or “small business” to be eligible for the payroll offset?

- Can companies formed more than five years ago benefit from the payroll offset?

- And many more…

Our team provides businesses information needed to make an informed decision about whether you qualify for the R&D Tax Credit and if it is right for you. Call us for a review.

Ron Leger is a Massachusetts based CPA who specializes in the R&D Tax credit and taxes for businesses, individuals, trusts and tax exempt organizations. Contact us today!