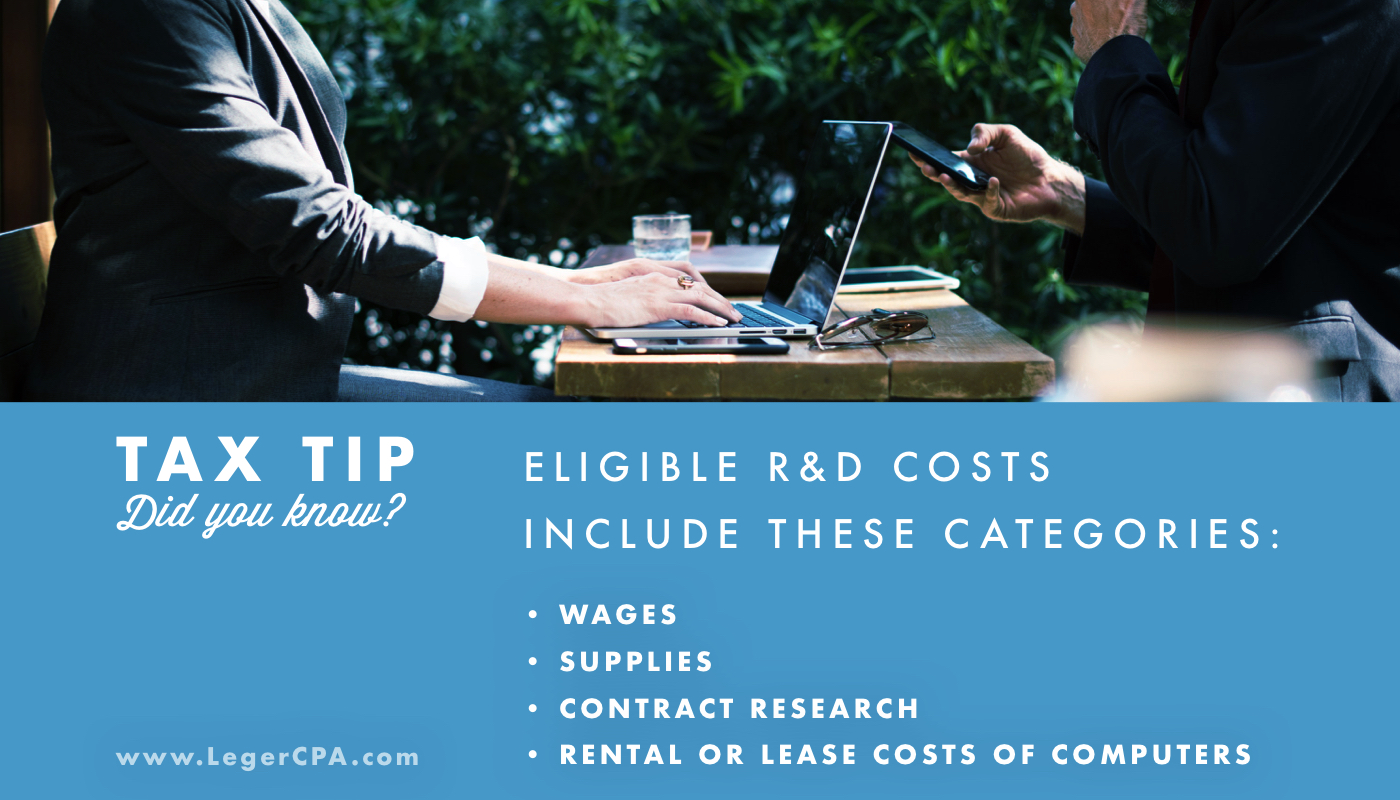

Eligible R&D (Research & Development) costs include these categories:

- Wages: W-2 taxable wages for employees offering direct support and first-level supervision of research.

- Supplies: Supplies used in research, including so-called extraordinary utilities but not capital items or general administrative supplies.

- Contract research: Certain subcontractor expenses (provided the subcontractor’s tasks would qualify if they were instead being performed by an employee). These can include labor, services, or research, but payment can’t be contingent on results. In addition, the taxpayer must retain substantial rights in the results, whether exclusive or shared.

- Rental or lease costs of computers. This could include payments made to cloud service providers (CSPs) for the cost of renting server space, as longs as payments are related to hosting software under development versus payments for hosting a stable software release.

Ron Leger is a Massachusetts based CPA who specializes in the R&D Tax credit and taxes for businesses, individuals, trusts and tax exempt organizations. Contact us today!